Planning Your Retirement: Maximizing Your Pension Potential

Understanding Pension Plans: The Foundation of Retirement

Retirement planning is a crucial aspect of financial stability in one’s later years, and understanding pension plans is the first step towards maximizing your pension potential. A pension plan is essentially a retirement savings plan sponsored by an employer or set up individually, which provides a steady income stream upon retirement. These plans can be broadly categorized into defined benefit plans and defined contribution plans.

Defined benefit plans guarantee a specific payout upon retirement, which is calculated based on factors such as salary history and years of service. This type of plan provides a sense of security, as employees know exactly what to expect. On the other hand, defined contribution plans, such as 401(k) plans, depend on the contributions made by the employee and employer, as well as the performance of the investment options chosen. The final payout in such plans is not predetermined, making them more flexible but also somewhat unpredictable.

To make the most of your pension plan, it is essential to understand the details of your specific plan, including the retirement age, vesting period, and any potential penalties for early withdrawal. Regularly reviewing your plan’s performance and adjusting your contributions can help ensure that you are on track to meet your retirement goals. It’s also beneficial to consult with a financial advisor to explore additional retirement savings options and strategies.

Strategies for Maximizing Your Pension Potential

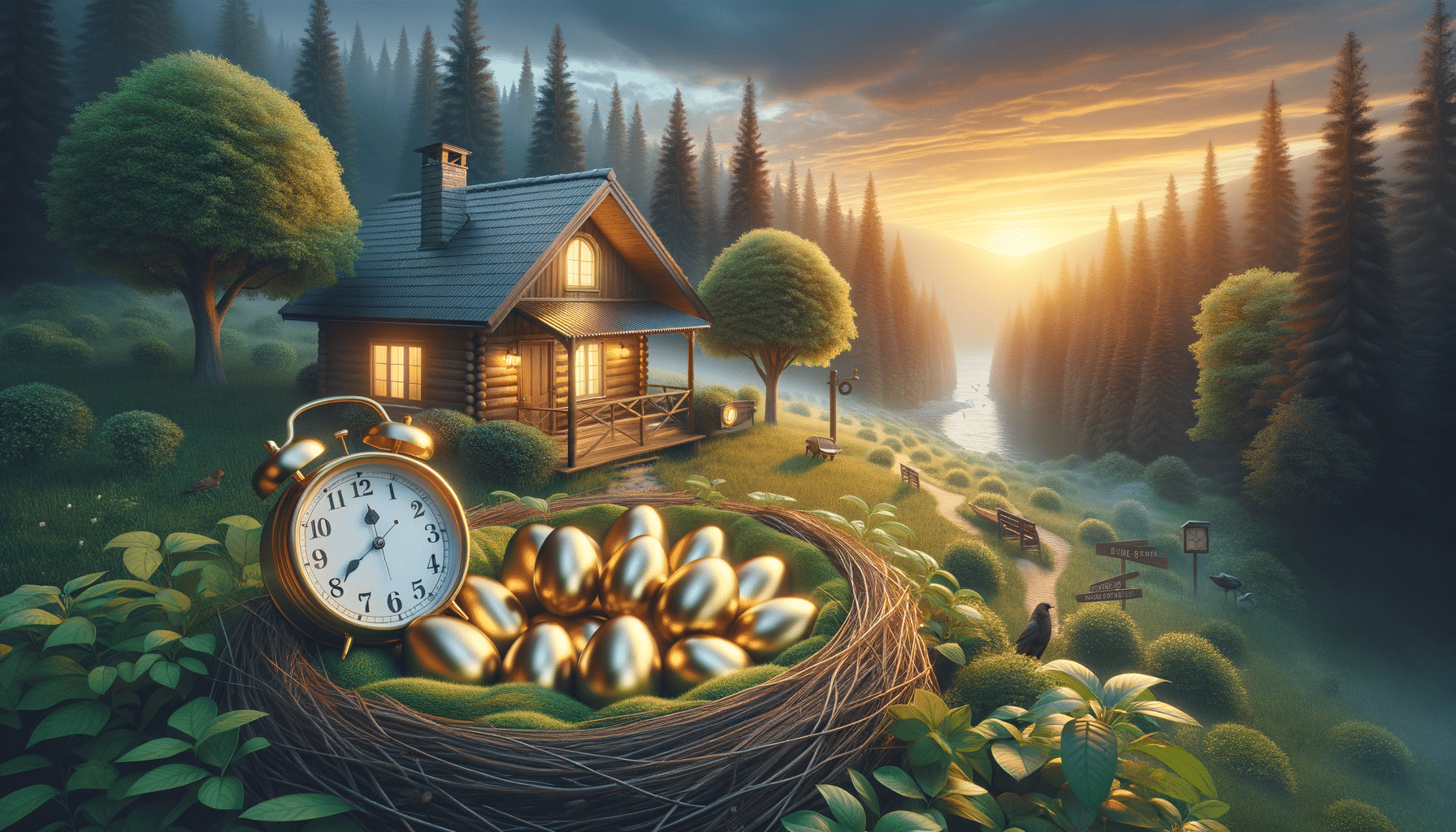

Maximizing your pension potential involves a combination of strategic planning and proactive management. One effective strategy is to start contributing to your pension plan as early as possible. The power of compound interest means that even small contributions can grow significantly over time. Additionally, taking advantage of any employer matching contributions can further enhance your retirement savings.

Another key strategy is to diversify your investment portfolio within your pension plan. By spreading your investments across various asset classes, you can minimize risk and increase the potential for growth. Regularly reviewing and rebalancing your portfolio ensures that it aligns with your risk tolerance and retirement goals.

Consider increasing your contributions whenever possible, especially when you receive a salary increase or bonus. Even small incremental increases can have a substantial impact on your pension fund over the long term. Additionally, staying informed about changes in pension regulations and tax laws can help you make informed decisions that maximize your pension benefits.

Navigating the Transition to Retirement

As you approach retirement, it’s important to carefully plan the transition from active employment to retirement. This includes deciding when to start drawing from your pension and how to manage your withdrawals to ensure a steady income throughout your retirement years. Timing your retirement can have significant implications for your pension benefits, as some plans offer higher payouts if you retire later.

Creating a comprehensive retirement budget is essential to understanding your financial needs and ensuring that your pension and other income sources can cover your expenses. Consider potential healthcare costs, inflation, and any plans for travel or leisure activities. Adjusting your lifestyle to align with your retirement income can help maintain financial stability.

It’s also beneficial to explore additional income streams, such as part-time work or passive income opportunities, to supplement your pension. This can provide a financial cushion and enhance your quality of life during retirement. By taking a proactive approach to retirement planning and staying informed about your pension options, you can maximize your pension potential and enjoy a fulfilling retirement.